High-frequency trading ( HFT) is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. ( October 2020) ( Learn how and when to remove this template message)

You may improve this article, discuss the issue on the talk page, or create a new article, as appropriate. You should carefully consider whether you understand how these instruments work and whether you can afford to take the high risk of losing your money.FX Empire encourages you to perform your own research before making any investment decision, and to avoid investing in any financial instrument which you do not fully understand how it works and what are the risks involved.The examples and perspective in this article may not represent a worldwide view of the subject. Both cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money. Risk Disclaimers This website includes information about cryptocurrencies, contracts for difference (CFDs) and other financial instruments, and about brokers, exchanges and other entities trading in such instruments. FX Empire does not endorse any third party or recommends using any third party's services, and does not assume responsibility for your use of any such third party's website or services.FX Empire and its employees, officers, subsidiaries and associates, are not liable nor shall they be held liable for any loss or damage resulting from your use of the website or reliance on the information provided on this website. FX Empire does not provide any warranty regarding any of the information contained in the website, and shall bear no responsibility for any trading losses you might incur as a result of using any information contained in the website.The website may include advertisements and other promotional contents, and FX Empire may receive compensation from third parties in connection with the content.

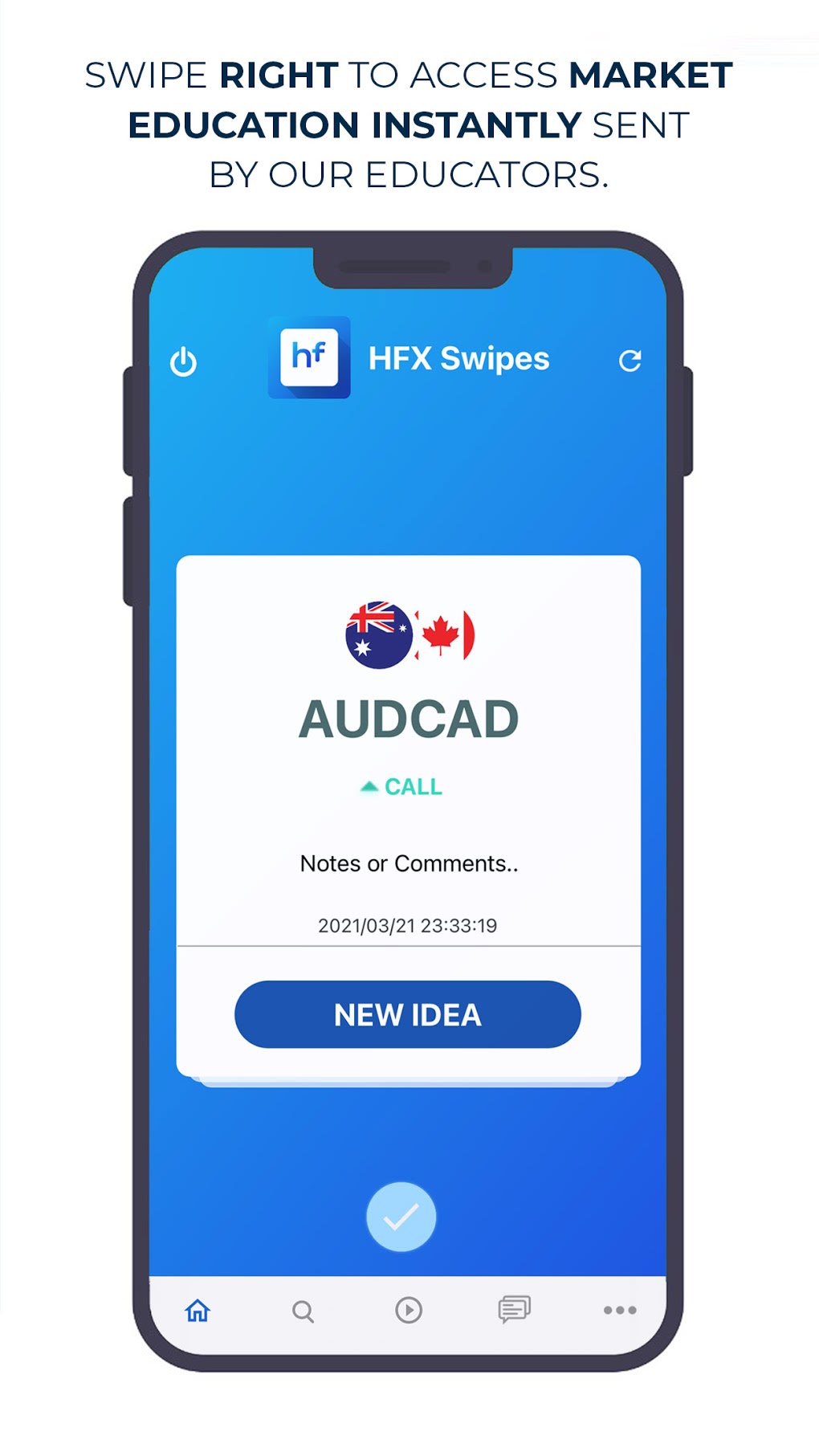

#Hfx trading full

Prices provided herein may be provided by market makers and not by exchanges.Any trading or other financial decision you make shall be at your full responsibility, and you must not rely on any information provided through the website. The content of the website is not personally directed to you, and we does not take into account your financial situation or needs.The information contained in this website is not necessarily provided in real-time nor is it necessarily accurate. When making any financial decision, you should perform your own due diligence checks, apply your own discretion and consult your competent advisors. It does not constitute, and should not be read as, any recommendation or advice to take any action whatsoever, including to make any investment or buy any product. Important Disclaimers The content provided on the website includes general news and publications, our personal analysis and opinions, and contents provided by third parties, which are intended for educational and research purposes only. We could be seeing something like that trying to form, but we need some type of catalyst, perhaps some type of financial crisis kicking off, which is not much of a stretch of the imagination at this point.įor a look at all of today’s economic events, check out our economic calendar. Anything above $30 opens up a path toward the $50 level something silver has attempted several times in the last several decades. If we break above the recent high, the market could look to the $27 level, perhaps even the $30 level, on a longer-term trade. In that scenario, I think that silver could really start to collapse, but it would probably be accompanied by some type of spike in the value of the US dollar. In fact, it’s not until we break down below the $23 level that I can take a breakdown very seriously. I think that if we pull back to that area, there will probably be plenty of traders willing to get involved in the market for that type of debt. Underneath, the 50-Day EMA is racing toward the $24 level, an area that I pay close attention to due to the fact that it had previously been the epicenter of a massive consolidation area during this past winter. Because of this, I think you have a bit of a “push/pull” type of environment in the short term.

However, it’s probably worth noting that silver is also an industrial metal, so it does not help the idea of the market going higher, as demand is almost certainly dropping. Quite frankly, the world seems to be teetering on edge with something kind of ugly financially, and silver could be a way that people are looking to protect wealth.

0 kommentar(er)

0 kommentar(er)